Capital One is making another acquisition in the fintech space, this time snatching up the price tracking service Paribus, which helps online shoppers get automatic refunds when prices drop on items they purchased. Deal terms were not disclosed, but the acquisition involves bring both the team and the technology itself to Capital One.

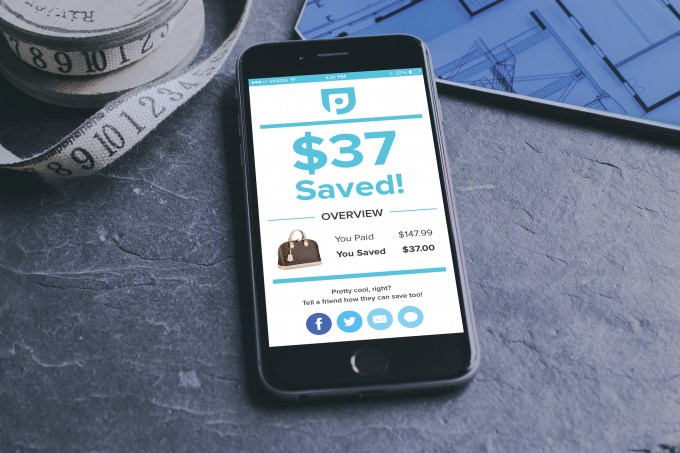

Launched in the Startup Battlefield at TechCrunch Disrupt NY 2015, Paribus’ idea was to automate the process of following up on past purchases to see if shoppers could request a refund from the online retailer. Many retailers offer post-purchase price matches, but most consumers don’t bother to watch the prices fluctuate after they complete the checkout process.

Paribus instead integrates with your email provider – like Gmail, Outlook, or Yahoo, for example – in order to scan your inbox for receipts of online purchases. When it finds one, it will then watch the item for a price drop within the store’s price match claim window. The service works with a number of online retailers, including Amazon, Best Buy, Walmart, Target, Bloomingdale’s, Macy’s, Bonobos, J.Crew, NewEgg, Costco, Staples, Kohl’s, and many others.

The startup has raised $2.22 million in outside funding to date and has a team of 12, all of whom are now joining Capital One. Paribus founders Eric Glyman and Karim Atiyeh are joining Capital One as Senior Directors in U.S. Card.

“We are incredibly impressed with the level of talent, the innovative technology that they have and are developing, and their steadfast mission to deliver effortless experiences for its users,” says Emilia Lopez, Managing Vice President, U.S. Card at Capital One, about why the company decided to snatch up Paribus.

“Our focus right now is on merging Paribus into the broader Capital One family, and adding the Paribus product into the broader set of technology and tools aimed at making people’s lives easier, like CreditWise and Second Look,” Lopez added.

Paribus had over 700,000 users at the time of the deal, and co-founder Glyman says the team was happy with the direction and growth over the past year, though he would not speak to revenue details.

“Like many startups that have grown as quickly as we have in one year’s time, we had many paths,” Glyman says. “We chose to join forces with Capital One. We could not be more excited to supercharge our efforts within an innovative technology company, and are energized by a combined focus on building great technology for consumers.”

Paribus will not be shutting down following the acquisition, but instead will work along with Capital One to expand into new money-saving areas. The company was already working on a new product that would focus on credit card price protection, so that seems to be a likely next step for business.

The acquisition is now one of several Capital One has made in recent years to beef up its tech talent and offer more modern, innovative services to customers. It also acquired startups like Bundle, BankOns, Adaptive Path, and last year, Level Money and Monsoon.

No comments:

Post a Comment